Inflation in the United States fell this month to its lowest level in more than three years, adding to a string of positive economic news in the final weeks of the presidential campaign.

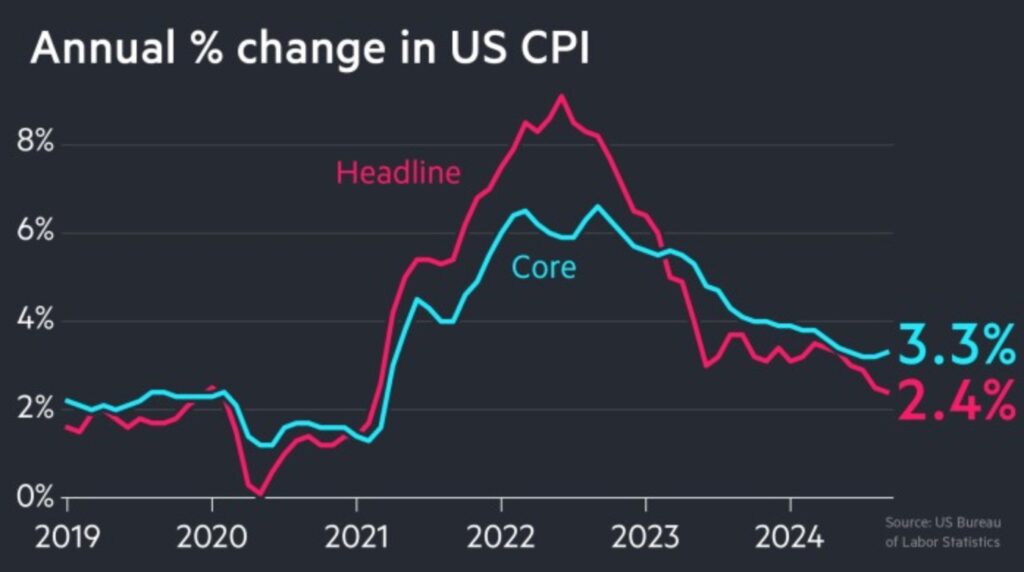

Consumer prices increased by just 2.4% in September from the previous year, down from 2.5% in August and the lowest annual increase since February 2021. Prices rose 0.2% from August to September, the Labor Department announced Thursday, matching the previous month’s gain.

However, removing volatile food and energy costs, “core” prices, a measure of underlying inflation, remained high in September, led by increased medical care, clothes, vehicle insurance, and airline tickets. In September, core prices rose 3.3% from a year earlier and 0.3% from August. Economists pay particular attention to core prices, which often give a better indicator of future inflation.

Alan Detmeister, an economist at UBS Investment Bank, predicted that several products that contributed to increased core inflation last month, namely used vehicles, may climb again in the coming months, keeping prices somewhat elevated. Other things that increased in price in September, such as apparel and airline tickets, are more volatile and should fall shortly.

READ MORE: Yes, Inflation Has Come For Tech Products Too

“Things are still gradually coming down, but there will be volatility month after month,” said Detmeister, a former Federal Reserve economist.

Overall, the September statistics suggest that inflation is gradually falling down to the Fed’s 2% objective, but in an inconsistent manner. This fall implies that the Fed will continue to lower its benchmark interest rate this year, with most analysts expecting two quarter-point reductions in November and December.

On a good side, apartment rental costs rose more slowly last month, indicating that housing inflation is now slowing, a long-awaited trend that will benefit many customers.

Omair Sharif, creator of Inflation Insights, said that measurements of new rents indicate a consistent deceleration, implying that the government’s rent gauges should continue to relax over time.

“I believe we’re on the right track here,” Sharif said. “We should see rent cool off quite a bit.”

Overall inflation was kept down last month by a significant decline in gasoline costs, which dropped 4.1% from August and September. Grocery prices rose 0.4% this month, after almost a year of gradual rises, although they are just 1.3% higher than a year ago.

READ MORE: A Man Who Was On Sick Leave For 15 Years Sues His Employer For Not Providing Him A Pay Increase

Nonetheless, food costs have risen by about 25% from pre-pandemic levels, wreaking havoc on many Americans’ finances and gaining attention in the presidential race. Trump has often used the price of bacon, which has risen 30% to a high of $7.60 a pound in October 2022, as an example of the rising expense of living. Bacon prices have recently dropped to $6.95, but they remain excessive.

Restaurant food costs rose 0.3% this month and are up 3.9% over the previous year. Clothing costs grew 1.1% between August and September, and are up 1.8% from a year ago.

The strengthening inflation picture comes after a mainly positive jobs report issued last week, which indicated that hiring picked up in September and the jobless rate fell from 4.2% to 4.1%. The government also stated that the economy grew at a steady 3% annual pace in the April-June quarter. Growth is anticipated to have continued at a similar rate in the just ended July-September quarter.

Cooling inflation, strong hiring, and good growth may diminish former President Donald Trump’s economic edge in the presidential race, as judged by public opinion surveys. In several polls, Vice President Kamala Harris has caught up with Trump on the question of who would best run the economy, after Trump had dramatically outperformed President Joe Biden on the subject.

At the same time, most voters continue to give the economy low scores, owing mostly to the cumulative increase in prices over the last three years.

Last week’s much-stronger-than-expected employment data raised concerns among the Fed that the economy may not be cooling enough to properly lower inflation. Last month, the central bank slashed its main rate by an unusually large half-point, the first rate decrease of any kind in four years. The Fed’s members also indicated that they expected two more quarter-point rate decreases in November and December.

In statements this week, a plethora of Fed officials said that they are still inclined to continue decreasing their key rate, but at a methodical pace, implying that any additional half-point reduction are improbable.

Lorie Logan, head of the Federal Reserve’s Dallas branch, said in a speech Wednesday that the Fed “should not rush to reduce” its benchmark rate, but instead do it gradually.

As COVID halted factories and choked supply lines, inflation in the United States, as well as many other nations in Europe and Latin America, skyrocketed throughout the economic recovery period. Russia’s invasion of Ukraine exacerbated oil and food shortages, driving prices higher. It reached a high of 9.1% in the United States in June 2022.

Goldman Sachs analysts predicted earlier this week that core inflation will fall to 3% by December 2024. Few economists believe inflation will rise again until Middle Eastern tensions intensify significantly.

Though increased prices have soured many Americans on the economy, salaries and incomes are now growing faster than expenses, making it easier for families to adjust. The Census Bureau announced last month that inflation-adjusted median household earnings—the level at which half of families are above and half below—will rise 4% in 2023, bringing incomes back to their pre-pandemic high.

In reaction to rising food costs, many customers have moved their purchasing from name brands to private labels or begun buying more often at bargain retailers. These reforms have placed more pressure on packaged food producers, for example, to restrain price increases.

PepsiCo said this week that its sales volumes had fallen after it raised prices on its beverages and snacks.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.