According to the IAB and PwC’s most recent Internet Advertising Revenue Report, total digital ad spending in the United States will increase by 7.3 percent in 2023 to $225 billion.

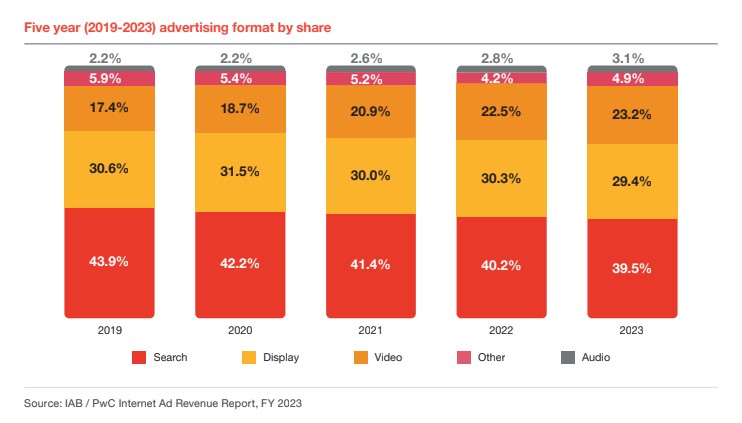

And video is a big driver of this expansion, having experienced the strongest growth rate in recent years, thanks to the influx of CTV inventory. Video revenues increased by 10.6 percent in 2023 to $52.1 billion. According to the survey, video now accounts for 23.2% of all digital ad income in the United States and is predicted to expand rapidly in the coming years.

READ MORE: Ad Spending On Linear TV Down 7% In February, According To Guideline

Video was not the only high-growth sector in 2023. Audio had the highest growth rate of any of the report’s primary categories, at 18.9 percent. However, it represents a far lower share of the market, with total revenues of $7.0 billion.

Meanwhile, search and display expanded more slowly but, given their scale, contributed significantly to revenue. Nonetheless, video generated more money last year ($5 billion) than any other category ($4.4 billion for search, $2.6 billion for display, and $1.1 billion for audio).

This extends video’s long-term growth streak. In 2019, video accounted for 17.4 percent of overall digital ad revenues, roughly half of display revenues (30.6 percent). However, video currently accounts for 23.2 percent of digital ad revenues, which is significantly closer to display’s 29.4 percent share. The report’s qualitative data suggests that video as a whole will continue to rise, with respondents to the IAB and PwC surveys predicting greater growth in revenues earned across internet video, CTV, and OTT next year.

CTV drives video’s growth.

READ MORE: Linear TV Ad Spending Fell By 7% In The Fourth Quarter, According To Guidelines

The proliferation of connected TV is unavoidably a significant contributor. CTV and OTT accounted for 42% of overall video ad revenues last year. CTV and OTT are forecast to be the fastest expanding media channels in 2024, with total spending on TV and CTV increasing by $12 billion between 2023 and 2027.

According to the survey, last year’s Hollywood strikes, combined with decreasing viewing of scripted episodes and reruns, shifted ad dollars away from established broadcasters and toward independent and non-unionized streaming and social platforms. Upcoming talks for live sports rights may speed the movement of ad dollars to CTV even more.

The research emphasized NBA league broadcasting rights, which are up for negotiation at the end of the 2024-25 season, driving both traditional sports broadcasters and streaming services to increase live sports streaming. Meanwhile, players across the board are increasingly monetizing sports-related material other than live broadcasters, such as influencer-led content and highlight packages.

Formats multiply, but concentrations rise.

As previously stated, CTV’s development is creating chances for smaller entities outside of established broadcasters to generate and monetize TV content. Meanwhile, retail media, another rapidly growing industry (with some overlap with video and CTV), is attracting new firms to advertising.

READ MORE: TikTok Attracts Quarterly Ad Spend Of Over $1 Billion

Nonetheless, the top corporations in digital advertising continue to capture a greater share of ad income. The top ten corporations (not identified in the research) accounted for 79.8 percent of total digital ad revenue in 2023, up from 76.6 percent in 2019. Meanwhile, organizations outside the top 25 compete for only 12.4% of total online ad income, a decrease from 16.3% in 2019.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.