Alphabet, the company that owns Google, reported weaker-than-expected second-quarter earnings on Tuesday due to a shaky global economy that has already hurt Snap and Twitter’s ad sales.

Alphabet reported revenue of $69.7 billion for the quarter that ended on June 30, falling short of the $70 billion analysts surveyed by Yahoo Finance had predicted. The company’s earnings per share came in at $1.21, falling short of the $1.31 expectation.

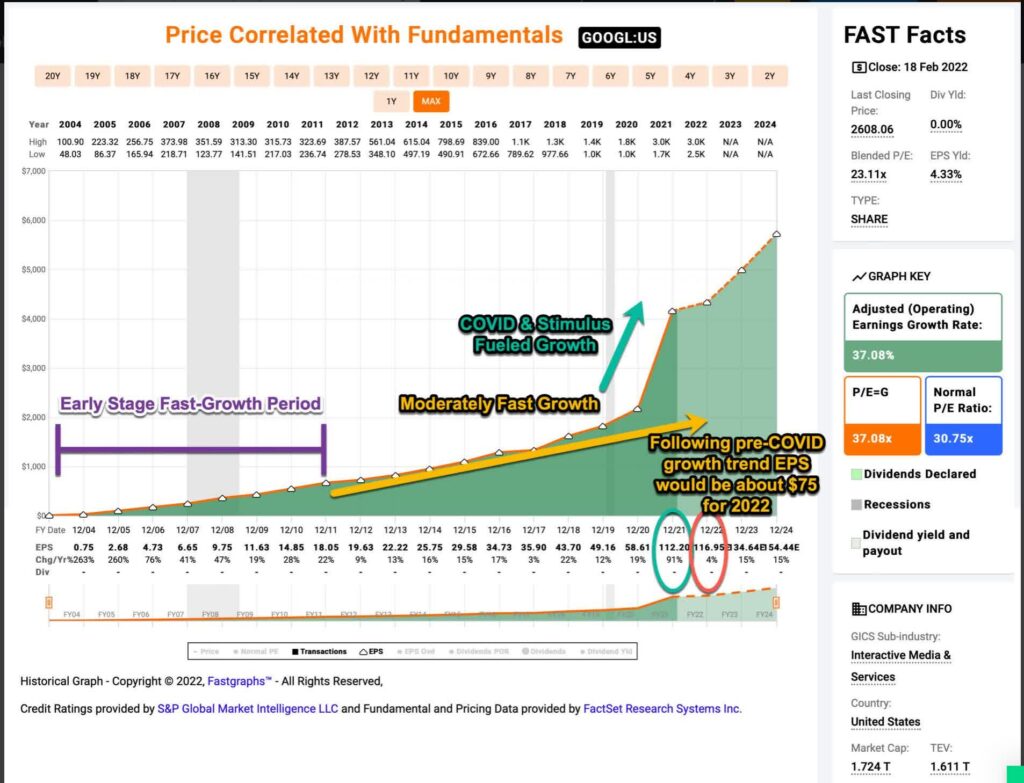

The company’s income generator, advertising, experienced disappointing performance as a result of the weakening economy. Despite not appearing to have suffered as much as smaller internet businesses, Google’s advertising division nonetheless operates in a challenging climate. The tech giant’s advertising income increased by 12 percent on a yearly basis to $56.3 billion, which is far less than the 69 percent rise seen a year before as businesses flocked to the internet to reach consumers at the height of the pandemic.

The good results from 2021, according to CFO Ruth Porat, made this year’s comparisons challenging.

On a conference call with analysts, she stated that “the really strong revenue performance from last year continues to produce unfavorable comps.” The remainder of the year, Porat continued, was likely to see slower year-over-year growth rates.

The corporation also had to contend with the rising dollar, which reduces the value of sales from international markets. According to Alphabet, the strong dollar reduced sales growth by 3.7 percent year over year.

To reach $6.3 billion, Google Cloud’s revenue climbed by nearly 36% from the previous year. However, despite losses increasing by little more than 45 percent to $858 million, the sector is still not profitable. According to Statista, Google holds around a tenth of the market and is the third-largest cloud provider.

The number of employees at Alphabet increased from 144,000 to 174,000 during the course of a year, a growth that is unlikely to sustain. Sundar Pichai, the CEO, has already declared that the company will reduce recruiting.

It can be difficult to always find the time to make all the necessary readjustments when you’re in growth mode, according to Pichai.

The corporation also had to contend with the rising dollar, which reduces the value of sales from international markets. According to Alphabet, the strong dollar reduced sales growth by 3.7 percent year over year.

Google’s findings are marginally worse than anticipated. When discussing with analysts, company leaders were upbeat and stated that advertising continues to innovate with additional partnerships.

According to Scott Sullivan, chief revenue officer at online advertising firm Adswerve, “As ad sales slump for many companies, Google has continually pulled in positive ad income by shifting its focus into areas where the company can be sharper.” According to Sullivan, Google’s consumer data and retailer alliances can help the company better prepare for a slowdown in e-commerce.

In after-hours trading, Google’s shares increased by more than 5% to $110.50. Earlier this year, Google split their stock 20 to 1.