Free, ad-supported streaming television (FAST) channels are proliferating and now provide more contemporary content than classic series like Leave it to Beaver.

A recent estimate from Nielsen’s Gracenote unit states that there were 1,189 active FAST channels in the United States in February, up more than 13% from 1,052 in May 2024. According to the survey, there are 108 FAST channels in Germany, 85 in Canada, and 153 in the United Kingdom. The number of channels in all four areas has increased by 42% since the middle of 2023.

Program owners have started making more recent series and films available for FAST distribution as the number of channels and viewers has increased.

READ MORE: Unleashing The Streaming Revolution: Exploring The Power Of OTT, CTV, And FAST TV

FAST used to be home to iconic black-and-white series like Leave It to Beaver and Gunsmoke, but according to the recent Gracenote analysis, Beyond Nostalgia, just 13.4% of the shows on FAST channels were produced before to 1990.

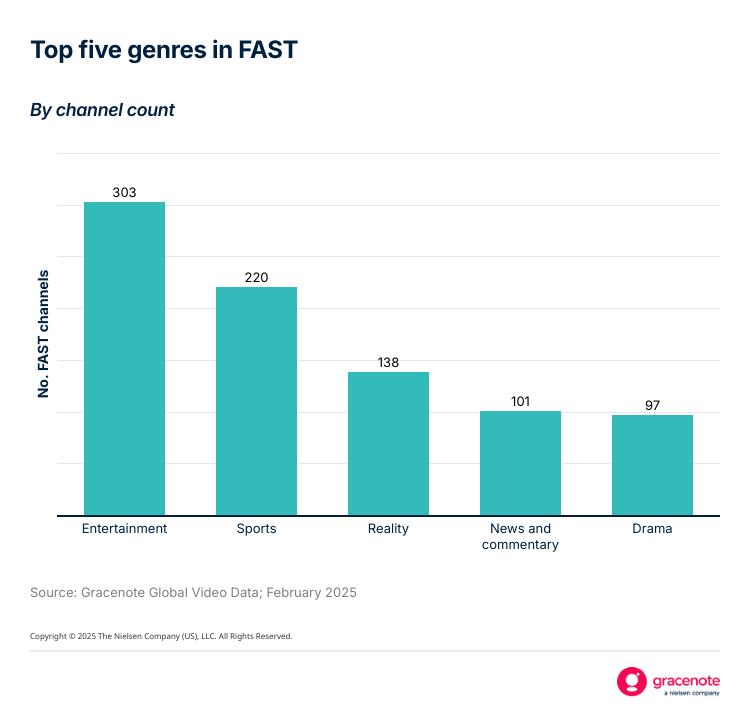

With almost 300 channels, entertainment is the most popular genre among FAST channels. Mukbo Brothers, You, Me and Joe, Pet Boulevard House, and The Grio Awards Red Carpet are among the programming on networks including Always Funny Videos, The Preview Channel, and the Just Fishing Channel, according to Gracenote.

Other prominent genres include reality TV (138 channels) and sports (220 channels). Comedy comes in sixth (90) while drama is the fifth most popular fast channel (37).

From just 19 in July 2024, reality is the channel genre with the quickest rate of growth. Additionally, the number of sports channels is growing quickly; in the last year, they have more than doubled.

READ MORE: In 2023, What Can We Anticipate From FAST TV?

Sports, reality, and news/commentary programming are the most common in the FAST world.

With the exception of the Super Bowl, which was streamed on Fox’s Tubi, Gracenote observes that sports content on FAST channels is currently hardly ever live.

According to the Gracenote analysis, “live sports are the next wave of content in the FAST space, and content owners will likely approach the distribution of live sports programming much narrower than they do with game transcripts and highlights.” “But unlike SVOD, the programming will be free, and this is already beginning to take shape.”

Gracenote notes that the content available on free streaming services is different from that available on subscription services. Sports programming made up just 1.3% of the content available on Amazon Prime Video, Apple TV+, Disney+, Netflix, and Paramount+, with 1.9% of the content falling into the entertainment area and 1.9% into reality. In February, drama accounted for 23.4% of the available material on the SVOD service, making it the most popular genre.

READ MORE: By 2032, The Market For FAST (Free Ad-Supported TV) Channels Is Expected To Grow To $28 Billion

The fact that so few FAST channels offer exclusive material is another significant distinction between free and paid streaming platforms. Ninety-three percent of the content on the five subscription sites under investigation is exclusive.

According to Gracenote, the main factors driving the expansion of FAST channels include growing CTV access and smart TV ownership, as well as rising SVOD prices and free, anonymous access to an expanding content library.

With 178,000 programs available and more FAST Channels going online, search and discovery are becoming increasingly important for distributors and viewers alike.

According to Tim Cutting, Chief Revenue Officer at Gracenote, “FAST is a unique service in many ways, but its lifeblood is still content.” “Therefore, program-level metadata that facilitates comprehension of FAST content is more crucial than ever for advertising campaigns and audience engagement.”

According to a Gracenote investigation conducted in the middle of 2024, a substantial percentage of the shows that are broadcast on FAST channels do not have the essential information that viewers need to decide whether or not they are interested in them. For instance, genre information was missing from 31% of the TV shows that were submitted to Gracenote’s FAST database for metadata enrichment. Other metadata components like graphics, parental rating, and production year that aid in content search were also absent from many.

The absence of meta data not only hinders viewers’ ability to find what they want to watch on FAST channels, but it also deters programmatic ad sales.

According to a Grand View Research estimate cited in the paper, the worldwide FAST channel spent $9.4 billion in 2024. However, just 53% of respondents in Nielsen’s 2024 Annual Marketing stated they intend to raise their expenditure on CTV, and only 57% think the channel is effective due to problems like measurement difficulties.

Despite the significance of content, user experience has grown to be crucial in all areas of the congested TV market. “User experience becomes the primary value proposition to drive both differentiation and long-term business success in the expanding FAST realm, where content exclusivity has yet to materialize across channels and platforms,” the report adds.

Step into the ultimate entertainment experience with Radiant TV! Movies, TV series, exclusive interviews, live events, music, and more—stream anytime, anywhere. Download now on various devices including iPhone, Android, smart TVs, Apple TV, Fire Stick, and more!