Streaming TV continues to get all of the attention from marketers.

Much of this enthusiasm comes at the price of linear, which still accounts for about half of all TV watching. In the hurry to purchase streaming content, many marketers overlook certain crucial distinctions between what is described as streaming and what it truly entails.

For many people, video supplied via a platform like Amazon Prime Video instantly counts as streaming. What about programming given live, such as Thursday Night Football? Almost all viewers will engage with the information via the live linear stream, bringing it closer to linear television. Clearly, the language becomes muddled.

There is a similar haziness around CTV advertising and how marketers approach the channel. CTV is currently accessible in approximately 90% of US homes and accounts for one-third of watching time, although only 40% of CTV viewers are exposed to commercials in this setting.

READ MORE: Acquiring DISH For $1 Plus Debt, DIRECTV Officially Becomes The Biggest Pay-TV Provider In The US

Meanwhile, a major portion of the merchandise given to the 40% is sold linearly. This is particularly true for FAST networks, which presently represent for 20% to 25% of ad-supported streaming.

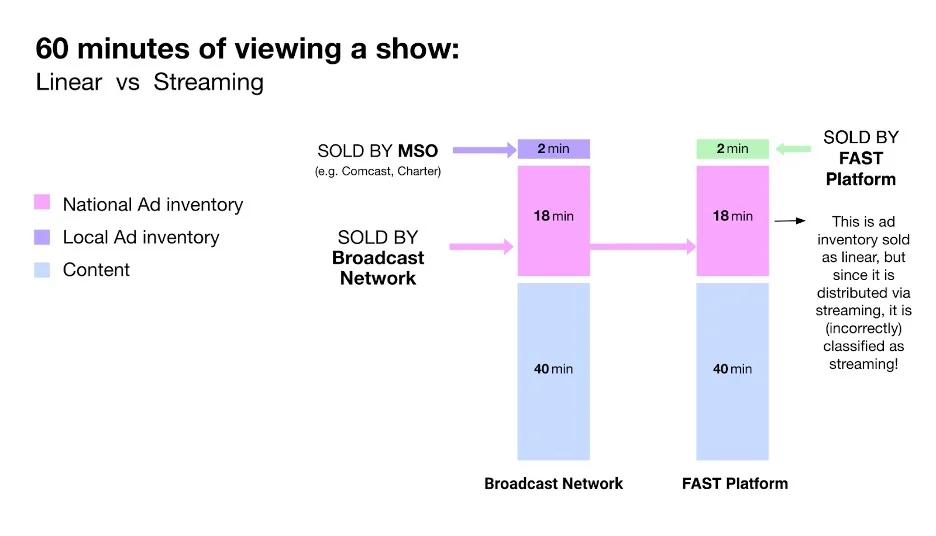

Let’s look at a one-hour prime-time broadcast that appears on both linear TV and a FAST channel.

Assume this show contains around 20 minutes of commercial time and 40 minutes of material. Those 20 minutes of advertising time are split further, with the cable network selling 18 minutes nationally and the cable network or MSO (such as Comcast or Charter) selling the remaining two minutes locally.

READ MORE: DirecTV To Release New Streaming Channels By Using The A+E Networks Library

The two minutes of commercial time that went to the MSO for the FAST airing, which takes place at the same time as the linear broadcast, is now sold by the FAST platform. In this situation, the FAST platform would be the content distributor, which may be a virtual MVPD (like YouTube TV or Sling) or a TV OEM (like the Roku Channel or VIZIO). Many people in the advertising business believe that the FAST platform will also sell the remaining 18 minutes of national ad time.

Those 18 minutes are identical to the 18 minutes of advertising paid by the national network for its linear broadcast. So, although all of this inventory is streamed to FAST viewers, it is sold linearly. From an advertiser’s perspective, classifying this as streaming is wrong.

To access the bulk of inventory that runs against a program on a FAST platform, ad buyers must make linear purchases. If FAST accounts for approximately a quarter of the ad-supported streaming industry, between 20% and 25% of all ad-supported streaming may only be acquired via linear. Some argue that more than 90% of all ad impressions provided by CTV are really aired.

READ MORE: Are Advertisers Adapting To The Shift In CTV Viewer Behavior?

This example highlights how little “true streaming” inventory is accessible via the DSPs and platforms that claim to link marketers and viewers. The FAST platform sold two minutes of goods, which accounts for just 10% of the program’s inventory.

Worse, this restricted inventory is sometimes offered at CPMs five times more than linear demands for the same impression. Buyers who actually intended to reach the program’s target demographic would have a far higher chance of connecting with them if they made the linear purchase. In this instance, they would have access to the whole audience, not just the percentage that watches via FAST.

This is just one of the many reasons why marketers shouldn’t hurry to include additional streaming inventory in their media strategy. Linear remains an excellent option for addressing audiences in an efficient, cost-effective, and high-performance manner at scale. There is enough of product to go around.

Those that opt to abandon linear in favor of streaming-only may find themselves vying for 10% of all impressions while their competitors discover a way to cost-effective air time.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.