DISH Network, a leading satellite TV provider, reported a net loss of around 104,000 Pay-TV subscribers in the second quarter of 2024, a substantial improvement over the 294,000 subscriber loss seen in the same time previous year.

The business attributed the slower fall to new subscribers to its SLING TV streaming service and lower churn rates for its regular DISH TV satellite service.

This comes as Sling TV resumed acquiring new subscribers in the second quarter after previously losing subscribers.

“The EchoStar team continues to perform as expected in the second quarter of 2024. We focused our efforts on harmonizing key business synergies and objectives, focusing on profitable customer acquisition and retention activities, and improving our go-to-market strategy for Retail Wireless,” stated Hamid Akhavan, president and CEO of EchoStar Corporation. “In addition, we are in constructive discussions to address necessary financing, working to strengthen our consumer offerings and value propositions, enhancing our state-of-the-art Open RAN network, and driving profitability across the enterprise.”

As of the conclusion of the second quarter, DISH Network had 8.07 million Pay-TV subscribers, including 6.07 million DISH TV subscribers and 2 million SLING TV members. While the company continues to experience issues in gaining new DISH TV customers, more SLING TV subscribers and improving retention rates provide a ray of optimism in the highly competitive pay-TV industry.

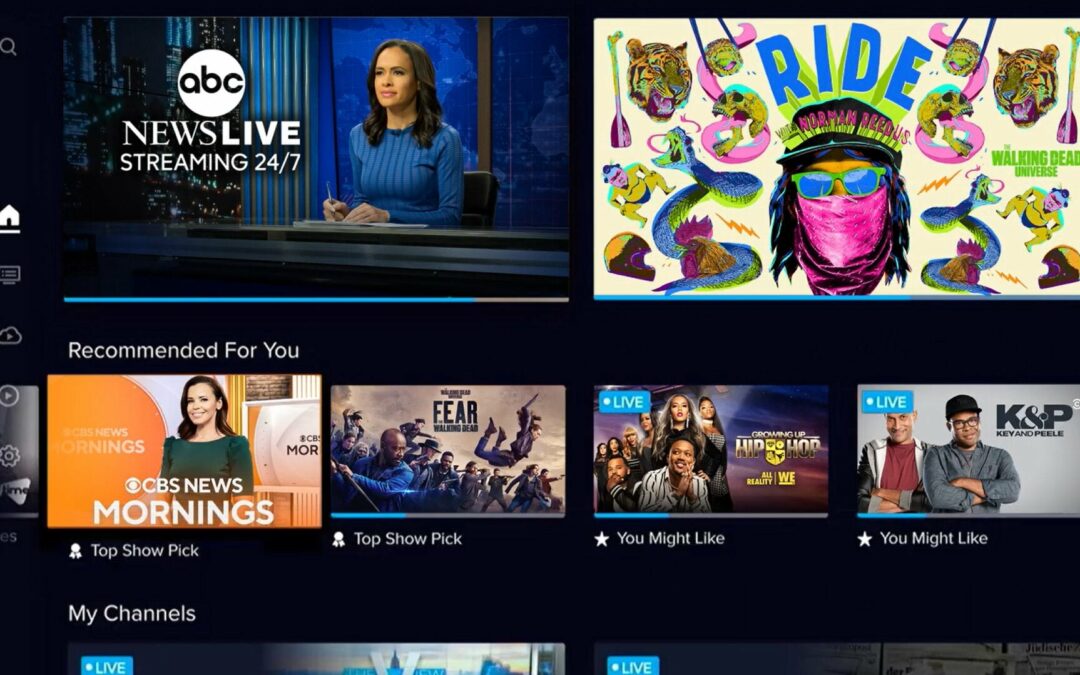

The company’s emphasis on expanding its streaming services and improving the customer experience looks to be paying off, as SLING TV emerges as a key driver of subscription growth. DISH Network’s attempts to stabilize its traditional satellite TV business, along with the expansion of its streaming platform, might help the company manage the continued cord-cutting trend and position itself for future growth in the ever-changing media landscape.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.