If social applications are seeking for ways to increase interest in their add-on subscription options, Snapchat is leading the way.

Snap announced last week, in its Q2 performance update, that its Snapchat+ subscription package now has 11 million paying subscribers.

This makes it the most successful of the recent wave of social subscription products, which, at least on Facebook and X, have emphasized verification as a bonus, essentially diminishing the value of the commodity that they’re attempting to sell.

This looks like a step backwards.

So, how has Snap fared with its offering? By understanding your audience and offering add-on features that people genuinely want.

READ MORE: Snapchat Introduces New AR Experiences For The 2024 Olympics

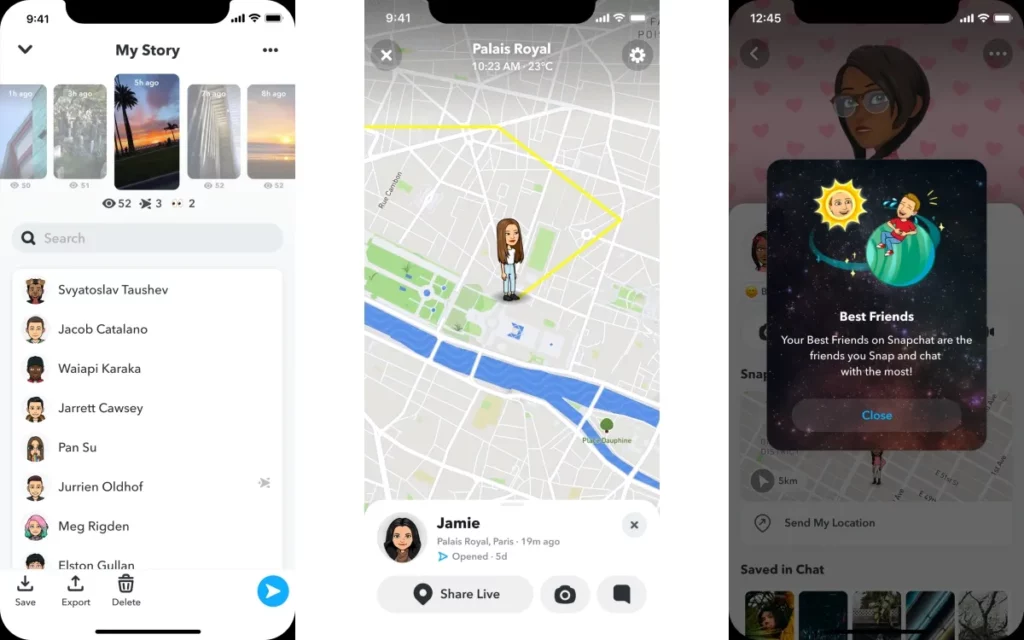

“In 2022, we launched Snapchat+ with only six experiences. Subscribers now have access to over 40 exclusive features, such as chat wallpapers, custom app icons, and AI Bitmoji Pets. Our Snapchat+ community has also been the first to explore some of our favorite features, such as Snapchat for Web and My AI, which are now available to Snapchat users worldwide.”

Snapchat has always been more linked to its user base, which has helped it achieve remarkable success with its AR capabilities. Because it understands what its consumers desire, and Snapchat+ exemplifies that connection and community awareness.

So, how effective is Snapchat+ as a subscription offering?

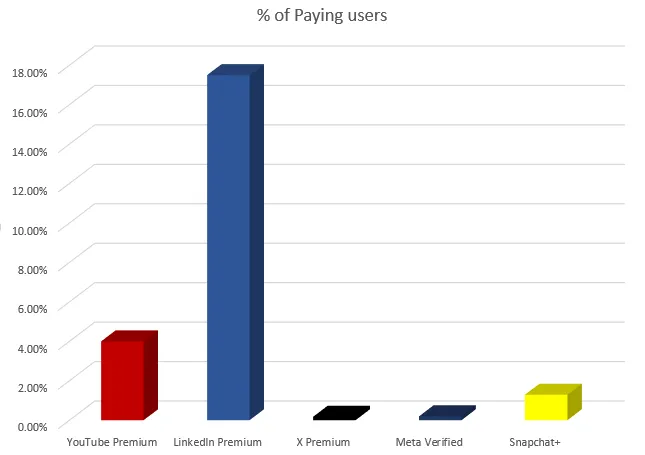

Based on reported data, this is where each subscription offering presently stands:

Paying users of social media apps

(It’s worth noting that these are estimations based on each company’s published stats, with just YouTube and Snapchat providing confirmed membership numbers.)

READ MORE: Snapchat Will Now Watermark Its Users’ AI-Generated Photographs

As you can see from the data, Snapchat has seen a much higher proportion of take-up for Snapchat+ than Meta and X have with their respective subscription offerings. The longer-standing add-on packages, such as LinkedIn Premium and YouTube Premium, remain more popular, but they’ve also been on the market for many years and provide alternative value, such as enhancing employment opportunities or removing advertisements from video viewing.

So LinkedIn Premium and YouTube Premium may not be precisely comparable in this regard; in any case, Snapchat has seen greater success than others in the new wave of subscriptions, providing the firm with another reliable cash stream.

So, what can Meta and X learn from Snapchat Plus?

Selling verification still appears to be a dead end, and even because some people will pay for a checkmark does not, in my judgment, imply that you should sell them.

But if there’s an opportunity for quick cash, it makes sense for them to take it; nevertheless, Snapchat has demonstrated that users will pay for add-ons that correlate with an improved user experience, rather than fake authority or prominence in the platform.

That appears to be the fundamental differential here, and Snapchat is winning in this regard.

It will be interesting to see how much Snapchat+ grows in the next months.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.