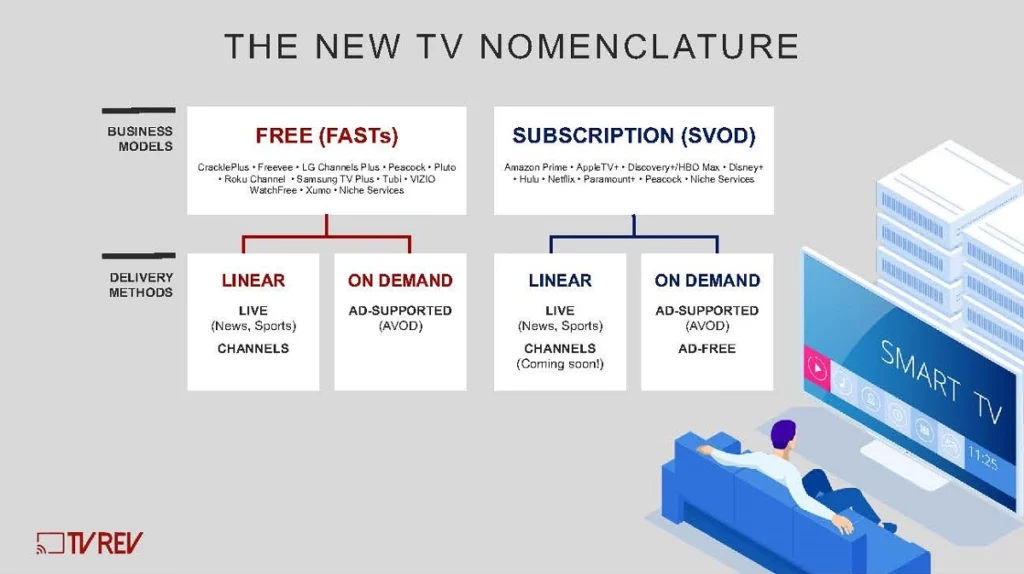

FAST seems to be Linear TV under a new name, only it uses the internet to transmit content rather than DTT, cable, or IPTV networks.

Perhaps this explains why FAST channels are a topic of confusion in the market for service providers and technology suppliers.

Are FAST networks linear editorially-managed channels or AVOD playlists? Do they cover both live and pre-recorded content? Even though some explanations are necessary, one thing is certain: FAST is rapidly securing its position in the media industry.

Why FAST Confuses, Yet Inspires

The first cause of some misunderstanding about FAST is the fact that the fundamental idea of free television with advertisements is nothing new, so what is the big deal? Industry veterans who have years of experience working with linear TV have a valid issue. According to Wikipedia, media analyst Alan Wolk is credited with coining the term “FAST” in a piece he penned in December 2018 that predicted the year 2019, citing the success of ROKU Channel and TubiTV as indicators of the demand for free, ad-supported television. Alan was correct; by the middle of 2022, there would be well over 1400 FAST networks available in the US market.

Industry veterans should be able to find some solace in the knowledge that there are undoubtedly some significant differences to warrant the hype given that these channels are distinct from the more than 1700 Linear TV channels in the USA.

The second source of misunderstanding is the fact that there are several approaches to developing a FAST channel. The crucial point to think about is standardization (i.e., editorially programmed and scheduled) vs. personalization (user-defined or user-assisted content and timing). What makes sense and what is even feasible given that the technical and operational execution of these two models is very different?

Despite the uncertainty, the FAST market is expanding as shown by the recent spike in channel counts. According to Omdia, there were over 1500 FAST channels available in the US alone as of January 2023. Annual revenue increased 20 times between 2019 and 2022 to hit about $4 billion, and it is anticipated that it will triple to over $12 billion by 2027. The largest market for FAST is the US. By 2027, it is predicted that 85% of FAST revenue will come from the US, down from an anticipated 90% today. This means that the FAST market outside of the US will be worth roughly $1.6 billion.

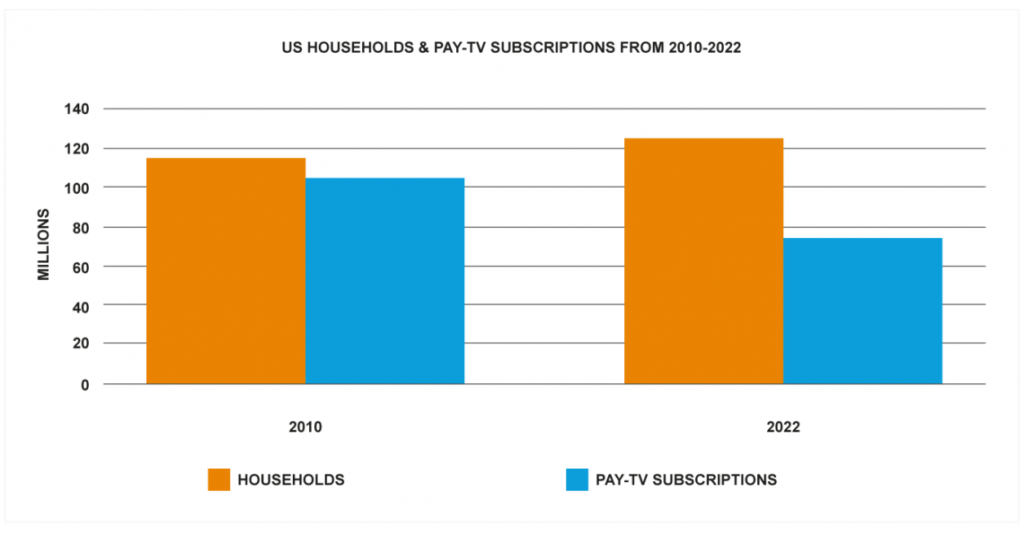

According to forecasts, this will primarily originate from the UK, Canada, Germany, and Brazil, in that sequence. FAST is a fascinating novelty in the US, possibly more so than in other developed media markets that are financed differently and that have not experienced as high levels of Pay-TV market penetration (see Figure 1). And while the cord-cutting trend has been fueled by VOD services over the past ten years, it will be fascinating to see if FAST fuels more cord-cutting over the following ten years.

It is not shocking that the FAST movement has gained momentum. FAST appeals to our desire to view low-effort content for free, much like the VOD revolution appealed to our desire to watch what we want when we want.

The commercial potential for FAST is high, particularly for smaller content creators and publishers, because it naturally aligns with our interests. Subscription business models typically depend on customer loyalty. If gaining a subscriber costs $50 and the monthly fee is $10, the user must remain a member for 5 months in order to break even. There will be a financial loss if the user binge-watches and then cancels before the five-month period is up. But with FAST services, the goal is similar to Linear’s: make the content appealing so that users will continue viewing the ads, which increases advertising revenue.

Additionally, due to the target audience’s niche nature, the value of a FAST ad spot is anticipated to be higher than usual. In mid-2022, LG Ads claimed that FAST channel advertisements tended to be shorter and more appealing as a result. It also stated that Connected TV households that watch FAST channels have higher household incomes than the national average. This is an alluring combination that will help FAST become a commercial hit and will spur the expansion of its services.

Differences Between Linear and Fast

It is evident from talking to business experts that there is misunderstanding regarding how to separate FAST from Linear. Let’s attempt to explain this now.

Like a linear channel, a FAST channel can mix live and recorded programming. Similar to a linear station, it has ads inserted into commercial breaks. It is editorially run and offers a schedule of programming, just like linear networks. These are the main parallels between linear TV networks and fast TV channels. Following this, things change in four key ways.

- Free – FAST is truly free content. Like logging into YouTube. Aside from the cost of connectivity and the device, which you would have anyway if you are an internet user, the content on FAST services is free. Some services, like Hulu, deliver FAST channels as part of a subscription service. But the concept of FAST is that it is free. There is no license fee to pay, as is paid in some countries to public service broadcasters, and there is no subscription to pay.

- Streaming – FAST channels are streaming only, and that means OTT only. They are not Linear channels streamed through the broadcaster’s own application, such as BBC1 on BBC iPlayer or RAI Uno on RAI Play. Those channels are consistent with what you can find on all other viewing platforms, like Satellite, IPTV, CableTV and Free-to-air broadcasting. FAST channels are distinguishable from those channels by only being available through the internet-based platforms like Connected-TVs, Apps and Web-browsers.

- “Niche” Linear – FAST channels have very focused content. For example, channels dedicated to Friends episodes, TED talks, or nature documentaries – there is a long list of channels with very specific content to appeal to very specific audiences. This is a level beyond what Linear can offer, primarily because of the lower cost of production and distribution that allows for experimentation.

- Personalized – The simplification of internet-based content distribution opens the door for mass-personalization. Traditional linear channels require transponder capacity for distribution and must feature in some form of EPG (electronic programme guide) on a Pay-TV or free-to-air platform. This is a more expensive way to distribute content than to utilize cloud-based playout, origination, and delivery platforms that can be paid for largely based on viewer consumption. So rather than knowing that you need 1 million viewers to justify the long-term cost of linear distribution, a FAST channel could have a good ROI based on a much lower number of highly specific viewers.

FAST is a low-friction method for a viewer to access content, according to Juliet Gauthier, FAST Product Manager at RedBee Media. You don’t need to join in. It’s wonderful from the audience’s perspective. A large number of networks are provided without charge. It offers high-quality material in an unusual and intriguing linear streaming style. You have the choice to access it along with on-demand libraries, which is typically the case. Even better, FAST introduces informal channel hopping to streaming for the first time. Compared to on-demand streaming, it’s a more relaxed viewing style, and we can see that there is certainly a place for that.

Disrupting The Pay-TV Model

FAST, like SVOD services before it, is upending the traditional Pay-TV business models, which has created a stir in the market. The USA had a 91% Pay-TV usage rate in 2010, and after just over 10 years of SVOD, that percentage has dropped to 59%. Now that FAST has arrived and rapidly taken off, we are examining the upcoming surge of disruption. Although each major Pay-TV operator in the US records subscriber losses every quarter, it is unclear how quickly Pay-TV subscriptions will continue to be cancelled.

Because the market share for Pay-TV has traditionally not been as high in the major European countries, when we look at Europe, we see a less extreme view. Nevertheless, OTT membership services have rapidly increased their market share. According to the UK’s BARB, for instance, 34% of households have a combination of Pay-TV and OTT subscriptions, while 10% of all households have at least one OTT ticket but no Pay-TV subscription.

Although these percentages—i.e., 78% of UK households—may remain high over time, the total amount of money households spend on media services could change considerably if FAST services replace Pay-TV services.

Time Will Tell

Particularly in the USA, where FAST channels clearly offer advantages over well-established Pay-TV services, FAST has expanded rapidly. There are some obvious differences between FAST and Linear TV, which point to a rising demand for FAST services. The existence of the FAST channels is still up in the air; will the top media companies make them broadly accessible across all platforms, or will content continue to reign supreme and force users to access the content provider’s own app in order to access the most expensively produced premium content? Only time will tell.

There are some important questions we have not yet addressed, regardless of which version of the future you believe is most probable. How does the need to produce viral content mesh with the personalization of FAST content? How do FAST channels take live material into account? In comparison to linear channels, how likely is it that FAST networks will become profitable? These questions’ responses will be covered in Part 2 of this essay series. For now at least, a relatively safe prediction to make is that the media and entertainment industry is unlikely to quickly turn on a dime towards only focusing on FAST channels instead of Linear, but it will invest in FAST as part of a blend of content delivery methods to best retain viewers’ interest.

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download